vermont sales tax exemption certificate

If you choose to expedite your application you will receive it in 2 business days. Step 1 Begin by downloading the Vermont Certificate of Exemption Form S-3.

Sales And Use Tax Department Of Taxes

Get a personalized recommendation tailored to your state and industry.

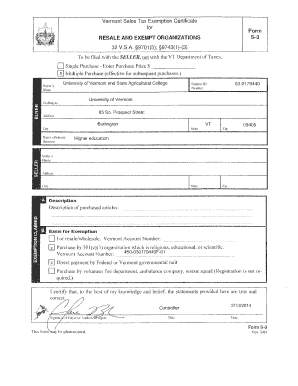

. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. 32 VSA 9741. Ad We process your resale certificate application within 5 business days.

This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use. For other Vermont sales tax exemption certificates go here. IN-111 Vermont Income Tax Return.

Ad Monoprice - Superior Performance Quality Great Prices. Tangible personal property for use as indicated on this exemption certificate. How to use sales tax exemption certificates in Vermont.

Exempt from Sales and Use tax. You must first be registered with Streamlined. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use TaxAct 194 S276 Secs.

BY DIRECT PAY PERMIT. Save on 1000s of Tech Products. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

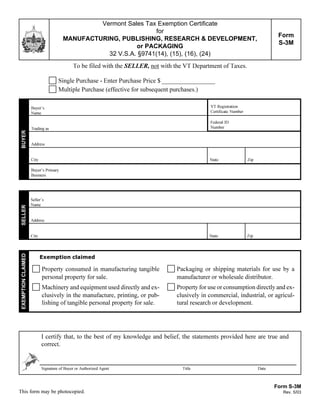

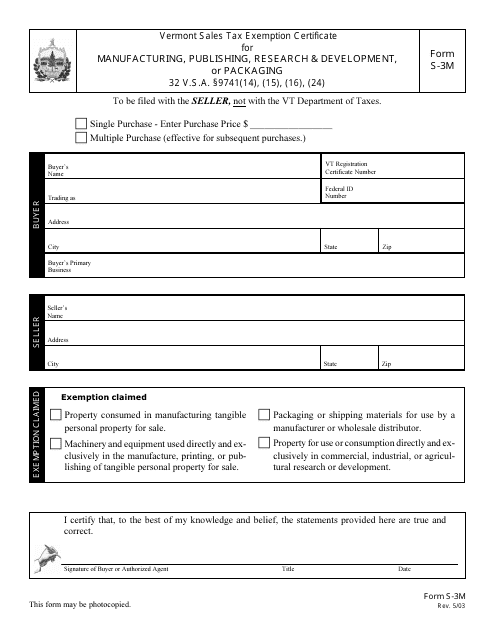

Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. S tep 2 Check whether the. Present vendor with completed VT Form S-3.

With a Vermont Sales Tax Permit youll obtain a Sales Use Tax Account Number for use when filling out the resale certificate. Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

803 Vermont Sales Tax Exemption Certificate for CONTRACTORS 32 VSA. Not with the Vermont Department of Taxes. Vermont Sales Tax Exemption Certificate for.

Fill out the Vermont Sales Tax Exemption. 974114 15 16 24. ˇ ˆ Form S-3C Rev.

PA-1 Special Power of Attorney. Basis for Exemption To be filed with theSELLER not with the VT Department of Taxes. Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now.

PURCHASES FOR RESALE BY EXEMPT ORGANIZATIONS AND. W-4VT Employees Withholding Allowance Certificate. Act 194 S276 Secs.

Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax. This page discusses various sales tax exemptions in Vermont. Free Fast Shipping Available.

Vermont Sales Tax Exemption Form Income tax Exemption Varieties arrive in a number of varieties. These include the Contractors Exemption Certificate Assistance in Fight. Examples of proof of registration are.

F or each purchase covered by the exemption certificate the sales slip or invoice must show the buyers name and. Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. Vermont Sales Tax Exemption Certificate for MANUFACTURING PUBLISHING RESEARCH DEVELOPMENT or PACKAGING 32 VSA.

Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. From Cables To 3D Printers You Find It All at Monoprice. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. Steps for filling out the S-3 Vermont Certificate of Exemption. Vermont Sales Tax Exemption Certificate for PURCHASES FOR RESALE AND BY EXEMPT.

Exemption for Advanced Wood Boilers. The purpose of this form is to simplify the reporting of your sales and use tax. Exemption for Advanced Wood Boilers.

Wednesday March 16 2022 - 1200. Submit a completed Certification of Tax Exemption form VT-014 with a completed Registration or Tax Title application VD-119. 32 VSA 9741.

Vermont School District Codes. Sales and Use Tax Certificate of Exempt Status CES CES Number 008-1026793280.

Printable Vermont Sales Tax Exemption Certificates

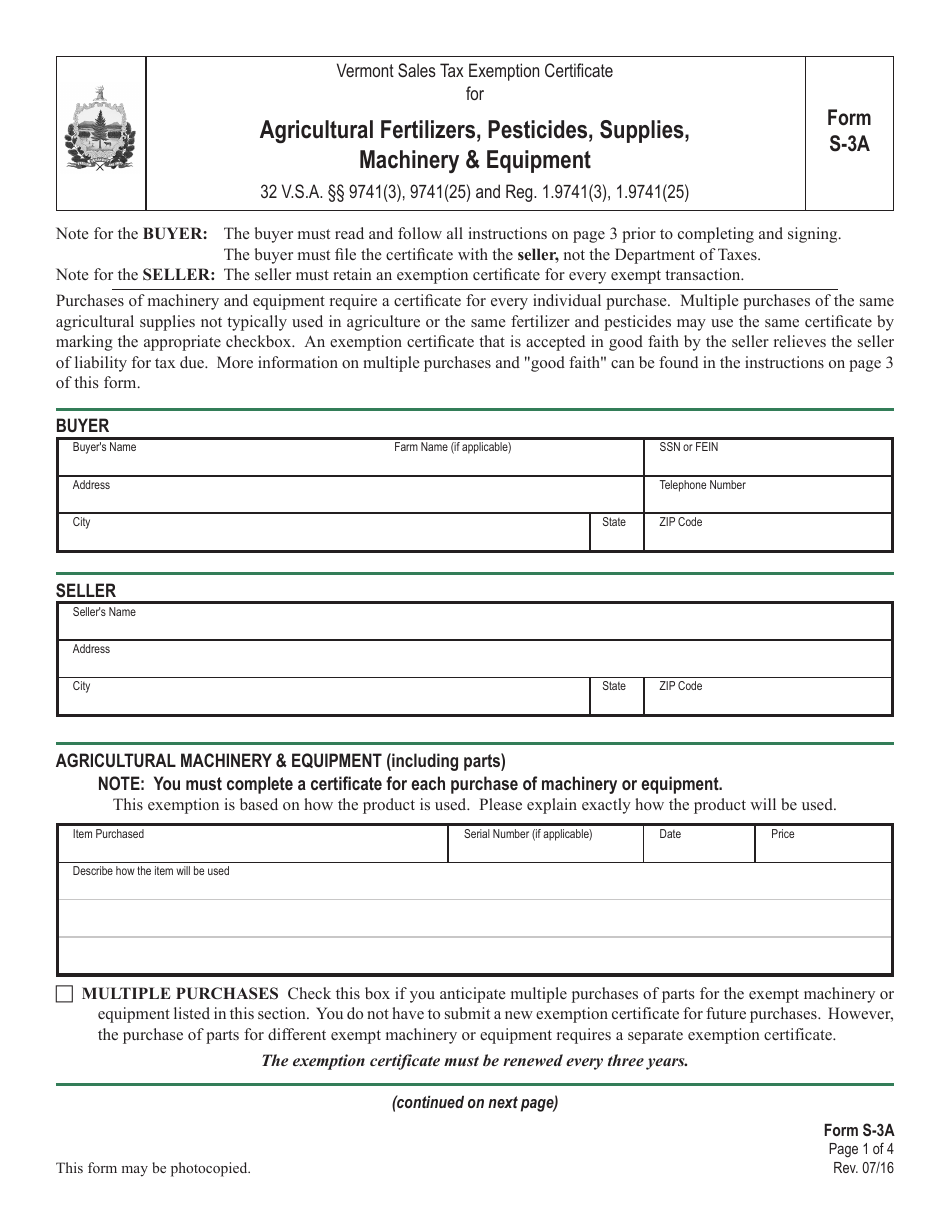

Form S 3a Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Agricultural Fertilizers Pesticides Supplies Machinery Equipment Vermont Templateroller

Sales Tax Laws By State Ultimate Guide For Business Owners

Fillable Online Form S 3 Vermont Sales Tax Exemption Certificate For Purchases For Fax Email Print Pdffiller

Sales Tax Exemption For Building Materials Used In State Construction Projects

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Vermont Senate Passes Sales Tax Exemption For Menstrual Products Vtdigger

Vermont Sales Tax Exemption Certificate For Form S

How To Get A Sales Tax Exemption Certificate In Utah

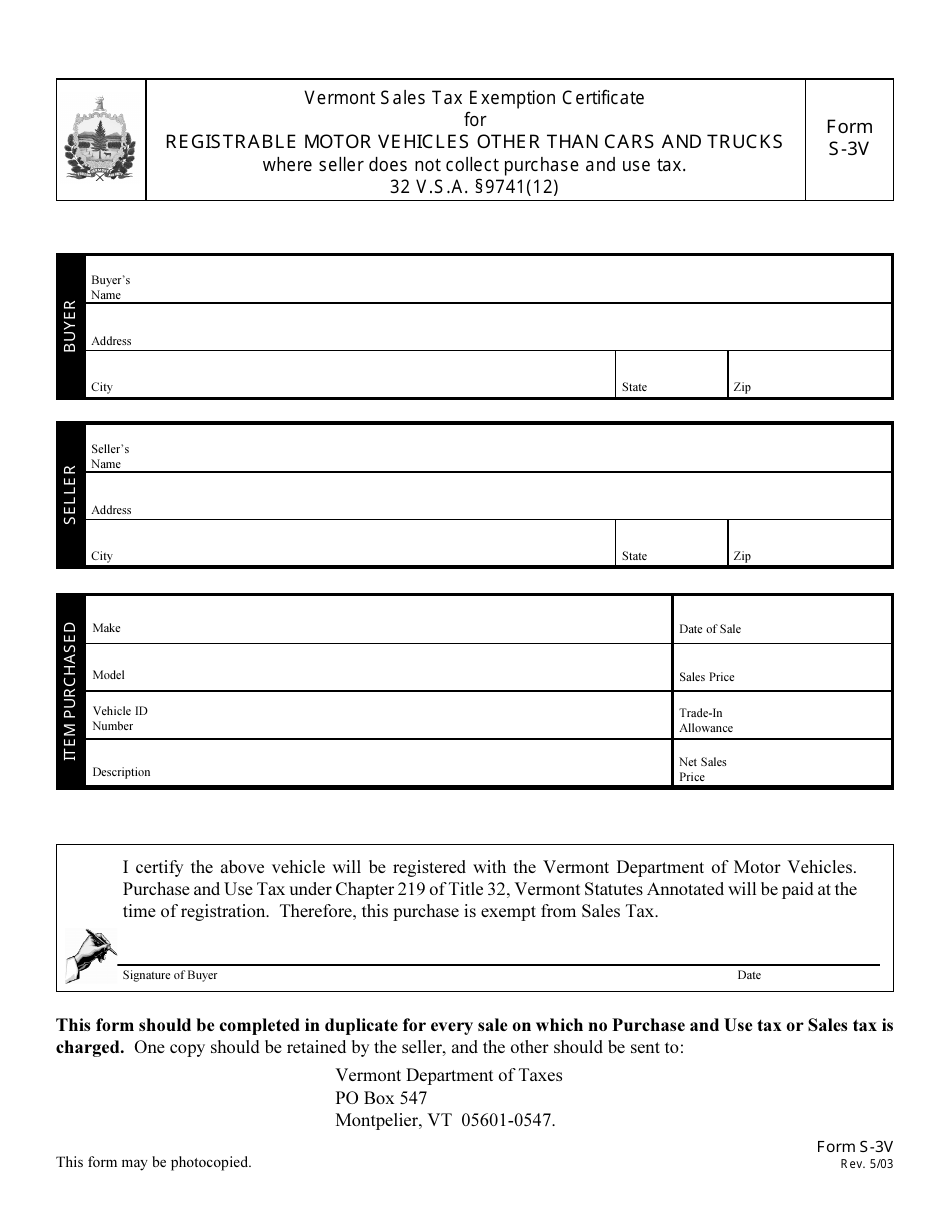

Form S 3v Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Registrable Motor Vehicles Other Than Cars And Trucks Vermont Templateroller

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

Vermont Sales Tax Exemption Certificate For Form S

Start A Nonprofit In Vermont Fast Online Filings

Sales Tax Tuesday Vermont Insightfulaccountant Com

What Is A Sales Tax Exemption Certificate And How Do I Get One